The vital element to contemplate is exactly how much danger you need to tackle, against the amount of cash you’re prepared to invest.

General Partnerships. Normal partnerships are classified as the worst. If your business companion has a private dispute that has nothing to do with you and he or she loses a lawsuit, you two are joined with the hip.

Consulting with an investment Qualified will become crucial when crafting strong wealth preservation strategies. These gurus have a nuanced understanding of the financial landscape, supplying a must have insights.

The assets within a revocable dwelling have confidence in are usually not protected against the have faith in creator’s creditors. A pick amount of states, however, make it possible for for domestic self-settled trusts which permit the have confidence in creator for being a have faith in beneficiary while nonetheless retaining asset protection for the belief assets.

A comprehensive will outlines your intentions Plainly. It designates beneficiaries and defines asset distribution.

When you are inside of a large-danger career, consider transferring assets to the heirs early – get in touch with it an “progress in your will.” If you don’t assume to wish The cash while you’re alive, you could possibly reap the benefits of looking at them additional reading benefit from the inheritance.

The tax landscape evolves often, and failing to keep up with these adjustments may be high priced. Being on top of present tax regulations, allowances, and reliefs is a great way to ensure your wealth thrives in an at any time-transforming tax natural environment.

Why you ought to open various savings accounts Five methods to save lots of and devote for a cushty retirement Leading strategies for earning far more fascination with your savings

Conducting complete critiques can help identify prospective hazards and alternatives, making certain that the wealth preservation plan stays resilient and effective.

Checking monetary markets is essential to safeguarding your assets for future generations. How can market fluctuations effects your wealth preservation strategies?

There are many aspects to weigh up when choosing a savings account. This manual explains which accounts are best suited to the conserving desires. Browse extra

For a general guideline, be certain your total webpage legal responsibility protection is at the least equivalent to the overall assets.

And overprotection taken to the intense can hamper your retirement savings. Beware of significant expenses on annuities, which often can erode your returns, and allocating far too much within your portfolio in the direction of CDs, funds market funds, and fixed earnings—which can give paltry interest premiums in small interest rate environments.

As an example, In case you have little ones from the former relationship and commingle an inheritance you get with your new spouse, Your kids may perhaps get a lot less than you anticipate after you pass away. This problem will become all the more detrimental if you are considering a divorce.

Shaun Weiss Then & Now!

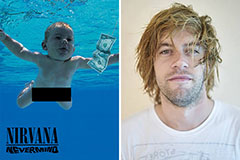

Shaun Weiss Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Danica McKellar Then & Now!

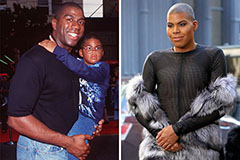

Danica McKellar Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!